EFT Service

The Aserv system is used to manage EFT transactions (Electronic Fund Transfer) from the level of the POS software.

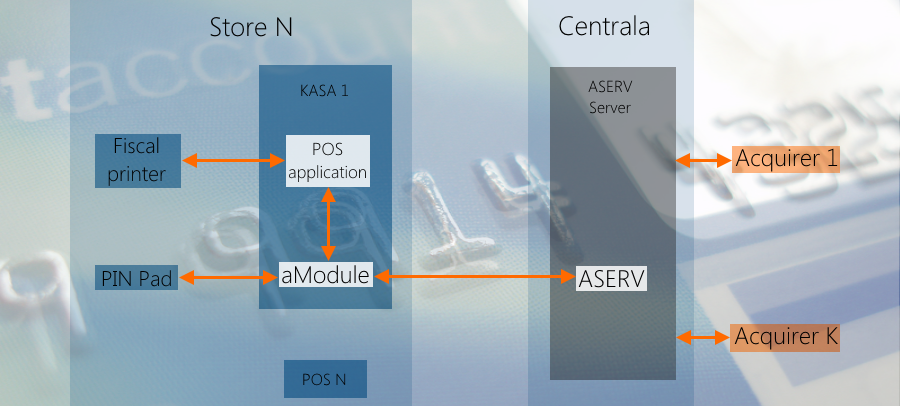

System architecture

The Aserv system consists of two main components: the Aserv software installed on central servers of the system and the aModule program, acting as an Aserv’s client, installed on each of the POS machines. aModule’s purpose is to communicate with the Aserv, the POS application and a PIN Pad if it is connected directly to the cash register. The solution provides support for PIN pads connected to cash registers (via COM or USB), as well as PIN pads communicating via LAN. Regardless of the method of the connection of a PIN pad, the system allows it to be shared by 2 or more cash registers.

Services supported by the ASERV system

ASERV system supports card payments and other types of transactions within the whole store chain. Our system received certification from four of the biggest acquirers in Poland, who account for Polcard (First Data Polska), eService, Elavon and Pekao. The system supports the following transactions:

- Payments with credit/debit cards (with magnetic stripe, EMV and contactless cards) – all types of cards accounted for by a particular operator: VISA, VISA Electron, Eurocard/Mastercard, Maestro, American Express, Diners, JCB, Lukas, Finplus, Cetelem, GE Capital Bank.

- Cash back – combines convenient payment for goods and services using a payment card with the ability to make cash withdrawals.

- DCC (Dynamic Currency Conversion) – this functionality allows customers who use cards issued abroad to choose the currency in which their payment will be accounted for (local or original currency). The cardholder benefits as they are offered a beneficial currency conversion, and it is profitable for the merchant because of the differences in currency rates (divided between the merchant and the operator).

- Mobile payments – support for the following systems: BLIK – solution endorsed by Polski Standard Płatności, available to customers of the following banks: Alior Bank, Banku Millennium, Bank Zachodni WBK, ING Bank Śląski, mBank (including Orange Finanse), as well as PKO Bank Polski and Inteligo, PeoPay – solution from Pekao S.A., iKasa – solution endorsed by Biedronka retail chain, cooperating with Pekao S.A., Getin and Alior, available for users who do not have accounts in these institutions, but will set up a prepaid account, such as ePurse.

- Stores’ own gift cards – sale of cards, card payments, top-ups.

- Electronic mobile phone top-ups– in cooperation with operators supporting these transactions (currently the solution cooperates with a couple of operators).

- Electricity top-ups.

- Sales of mobile phone top-ups – e.g. Telegrosik.

- Sales of e-books.

- Bulk payments – payments of electricity bills, telephone bills, etc.

- Sales of insurance.

The most important advantages of the ASERV system include:

- Only one authorization server – all of the abovementioned types of transactions carried out in a store chain, can be handled with the use of one ASERV server and a backup server,

- Reliability – achieved owing to the configuration with the backup server. The backup server operates independently from the main server, and is installed in a remote location,

- Flexibility – independent setup of all the parameters relating to particular types of transactions, not only for each store separately, but also separately for each of the POSs – changing the operator or the PIN pad model only results in changing the ASERV setup, and not the POS system (it is the Aserv that communicates with the PIN Pad),

- Speed and ease of use – achieved owing to the integration with the POS application. Selecting card payment in the POS application initiates the processing of payment for whole amount remaining to be paid. Card payment receipts are printed on fiscal printers – that are a lot faster than printers normally used in payment terminals.

- Efficiency – the ability to handle multiple transactions at the same time, even tens of thousands per hour,

- Availability of all transaction data - the system stores all the necessary information about completed and attempted transactions (e.g. the number of the POS and the cashier, time and date, the transaction number, the encoded card number, the amount of the transaction, the amount paid by card, the dispatch number, the information about the authorization, the customer’s confirmation method). The authorized employees of the store can view only the data relating to the transactions made in their store, and then generate a report. The authorized head office staff have access to all the transaction data in all the stores. The system also stores (without full paths) communication logs of all the transactions, making it easier to diagnose the causes of any problems.

- Compliance with PCI DSS (Payment Card Industry Data Security Standard) – ASERV received a certificate of compliance meeting safety requirements set by the card organizations for payment applications (PA DSS certificate). ASERV was placed on the list of authorized applications, which can be viewed by visiting www.pcisecuritystandards.org.

Proven solution

The ASERV system runs on more than 30,000 POSs. The largest installations support the hundreds of thousands of transactions per day.

PCI DSS certification

Credit card companies (VISA, Mastercard, etc.) require compliance of solutions used by merchants to handle credit card payments, with the requirements of the PCI DSS security standard (Payment Card Industry Data Security Standard). According to the guidelines of these card companies, the biggest merchants are required to outsource testing for the aforementioned compliance to certified auditors (i.e. QSA). Forcom supports its clients in conducting the certification in question.

Monitoring of the system operation

In order to allow monitoring of the operation of our ASERV system in the online mode, a monitoring software for ASERV was created. The client module of this software, installed in the headquarters of a chain store, enables the ongoing monitoring of the system operation – not only informing about errors, but also keeping track of the primary and secondary server load, total and current percentage of authorizations denied, percentage of authorization failures (their increase may indicate some problems or errors), or the most frequent causes of authorization denials. Owing to this, the detection of failures is really fast, which is crucial in case of, e.g. malfunctions in banks that result in card authorization denials. In such situations our software significantly speeds up the process of informing customers of a particular bank about any problems connected with credit/debit card support.